Advanced Accounting year end and latest payroll information

Last updated for year end 2018 and calendar year 2019 (updated 1/4/19,1/23/19,1/29/19)

See Addsum blogs for more recent payroll updates.

See Addsum blogs for more recent payroll updates.

Before your first payroll of the year, just do this:

PR-G Clear employees/process W-2s later

We remain fully committed to an integrated payroll module; it is part of what a complete accounting system must have, and it is not something that should be outsourced by the software. End users however may choose to have their

payroll needs outsourced in which case they can still process payroll related transactions in Advanced Accounting either through the payroll module to mirror what occurs on the outside or via a synchronizing general ledger entry.

Paperless Filing option flyer for 2018 tax forms

Detailed information re: new W-2 federal/state e-filing option

(procedure remains the same for 2018 e-filings, re-tested on Jan. 23, 2019 and passed; employee e-mail support added last year)

Five states now do not accept paper W-2 forms!

2019 information:

*W-2/W-3 and 1099/1096 changes for year ending 2018

*Federal withholding/other rates changes effective in 2018

State rate changes

IRS Form 941 and 940 form changes

*Includes: Federal tax table update, state logic changes, PR-G and SY-D updates (assumes that the 2015/2016 update at a minimum has been previously installed)

- There are no W-2 form changes nor W-3 form changes for the calendar year ending 2018. The W-3 form had a minor change in 2014.

There are no form 1099-MISC nor 1096 changes that impacts Advanced Accounting. Concerning other changes that go into effect starting in January 1, 2018, see below.

- These changes (applies to all versions of Advanced Accounting including legacy versions) should be made after your last 2018 payroll is processed, and after you have fully processed and finalized (or used the new "clear" option) your 2018 W-2's (which should be done prior to your first 2019 payroll):

- The social security tax wage limit for 2019 has increased from $128,400 to $132,900. The employee (and employer) rates remain at 6.2.

Procedure to verify/change: In SY-D, retrieve each division one at a time, press ENTER, PgDn, and verify that the employee and employer rates are 6.2. Update each division for the $132,900 change: continue to press ENTER until you return to the main screen then press F10 or click on the save button if the amount needs to be updated. Here you also update your new SUTA rate and limit as well as any new state disability rate/limit for the new year. The 2018 payroll update will automatically and update your divisions for this change.

The FUTA rate last changed to 6.0% on July 1, 2011 and remains in effect.

The additional medicare tax for eligible compensation paid over $200,000 that started in 2013 and remains in effect for 2014 thru 2019. Existing Advanced Accounting W-2/W-3 forms will handle this new additional tax for 2013 through 2019 as long as you have the 2015/2016 payroll updates.

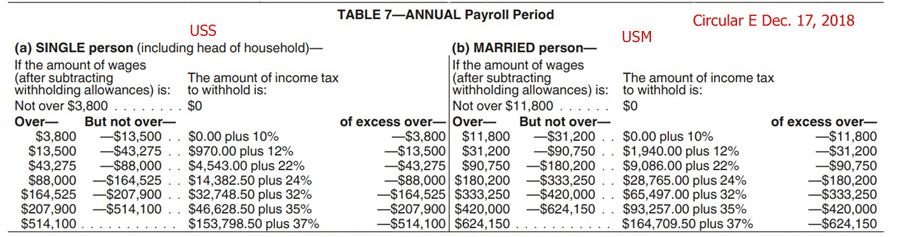

- Federal withholding tax rate changes An early release notice was posted by the IRS on Dec. 14, 2018. Circular E for 2019 was published on Dec. 17, 2018.

PR-K change for tax code US0 (single withholding allowance) has increased): PR-K, tax code US0 remains was $4,150 and is now $4,200 for 2019.

Change in Advanced Accounting required: PR-K, retrieve tax code USS then USM and follow Table 7. Update the from, to and tax amount columns (there are no changes in the "plus" % column). Use PR-K also to update changes in state tax rates if state follows same approach as federal. If your state has made changes and you cannot locate a corresponding tax code, please contact us (or call 801-277-9240)

Circular E, December Dec 17, 2018 Link: https://www.irs.gov/pub/irs-pdf/p15.pdf Publication 15 (Circular E) dated Dec. 17, 2018

Circular E, December Dec 17, 2018 Link: https://www.irs.gov/pub/irs-pdf/p15.pdf Publication 15 (Circular E) dated Dec. 17, 2018

The supplemental wage percentage for federal withholding changed from 25% as to 22% starting in 2018 and remains in effect for 2019. This 22% change was made in the 2018 payroll update. Advanced Accounting 6.1 starting with rel. 14 (and all releases of Advanced Accounting 7i) contains logic to handle both federal and state flat rate percentage supplemental wage withholding as we become aware of rate changes. Your state may also have a flat rate for supplemental wage (for example, bonuses) payments.

- More information:

- Adv 7i and 6.1 information (an editable W-2 capability was added in 2008); 941/W-2 enhancements made to 7i

- E-filing requirements:

- The SSA/IRA federal requirement to file W-2's electronically remains at 250, however, e-filing is encouraged by the IRS to improve accuracy and timeliness. E-submissions are also viewed by some as being more secure and less prone to identity theft.

- Connecticut, North Carolina, Oregon, Utah and Virginia are currently states that do not accept paper W-2 state form filings. The e-filing threshold for Minnesota is 10. Other states such as Alabama, Maryland, Mississipi, Rhode Island and Vermont, have a 25 forms or more requirement; for Indiana, it is 26. Others, including Idaho, Massachusetts, West Virginia and Wisconsin have a 50 employee requirement; for Nebraska, Kansas and New Mexico, the cut-off is 51.

- Clearly the state/federal trends will be for lower and lower thresholds.

- Tax and other forms

- State specific changes will be outlined here as we become aware of them: There are a number of states with changes. Our review is ongoing. A list of states that we have reviewed so far:

- California - tax table changes (numerous) eff. 1/1/19

- Colorado - tax table changes only eff. 1/1/19

- Michigan - personal exemtion change eff. 1/1/19 (program update required)

- Missouri - tax table and significant logic changes eff. 1/1/19 (program update required)

- Oregon - logic changes eff. 1/1/19 (program update required)

- New York - tax table changes only eff. 1/1/19

- Colorado - tax table changes only eff. 1/1/19

- IRS Forms 941 and 940

-

- The 941 program and report was updated in January of 2018 to synchronize it with form 941 line number changes and related verbiage.

- The 941 form was also updated during the first half of 2013 in connection with the additional medicare tax. The 941 and 940 programs were both updated in October of 2013 in connection with how they set the default rates. The 941 program's additional medicare tax logic was updated in Jan. of 2014 and again in Dec. of 2014, 2015 and 2016.

- The 941 program and report was updated in January of 2018 to synchronize it with form 941 line number changes and related verbiage.